Best Passive Income Investments: Earn While You Sleep

Contents:

Feeling like you're stuck on the hamster wheel of 9-to-5 life? Yeah, we do too. We've always been on the lookout for ways to kick back a little and let my money do the heavy lifting. So, we've been diving deep into the world of passive income ideas 2024 (and getting a head start for 2025).

Think of it: extra cash flowing in while you're binge-watching your favorite show, finally taking that vacation you've been dreaming of, or maybe even just challenging your brain with some fun brain exercises games. Sounds pretty good, right?

The term gets thrown around a lot, but what does it really mean? And how do you actually achieve it? That's what we're here to break down for you. We'll explore everything from passive income real estate to other, less conventional options.

What Is Passive Income?

Passive income meaning is income you earn that doesn't require you to actively work all the time to maintain. Nailing the passive income definition: Think of it as setting up a system, putting in effort upfront, and then reaping the rewards down the line, even while you're, say, binge-watching Netflix or finally tackling that DIY project you've been putting off. It's not "get rich quick," mind you, but it's about making your money work harder, not just you. It can give you some easy ideas with the right approach.

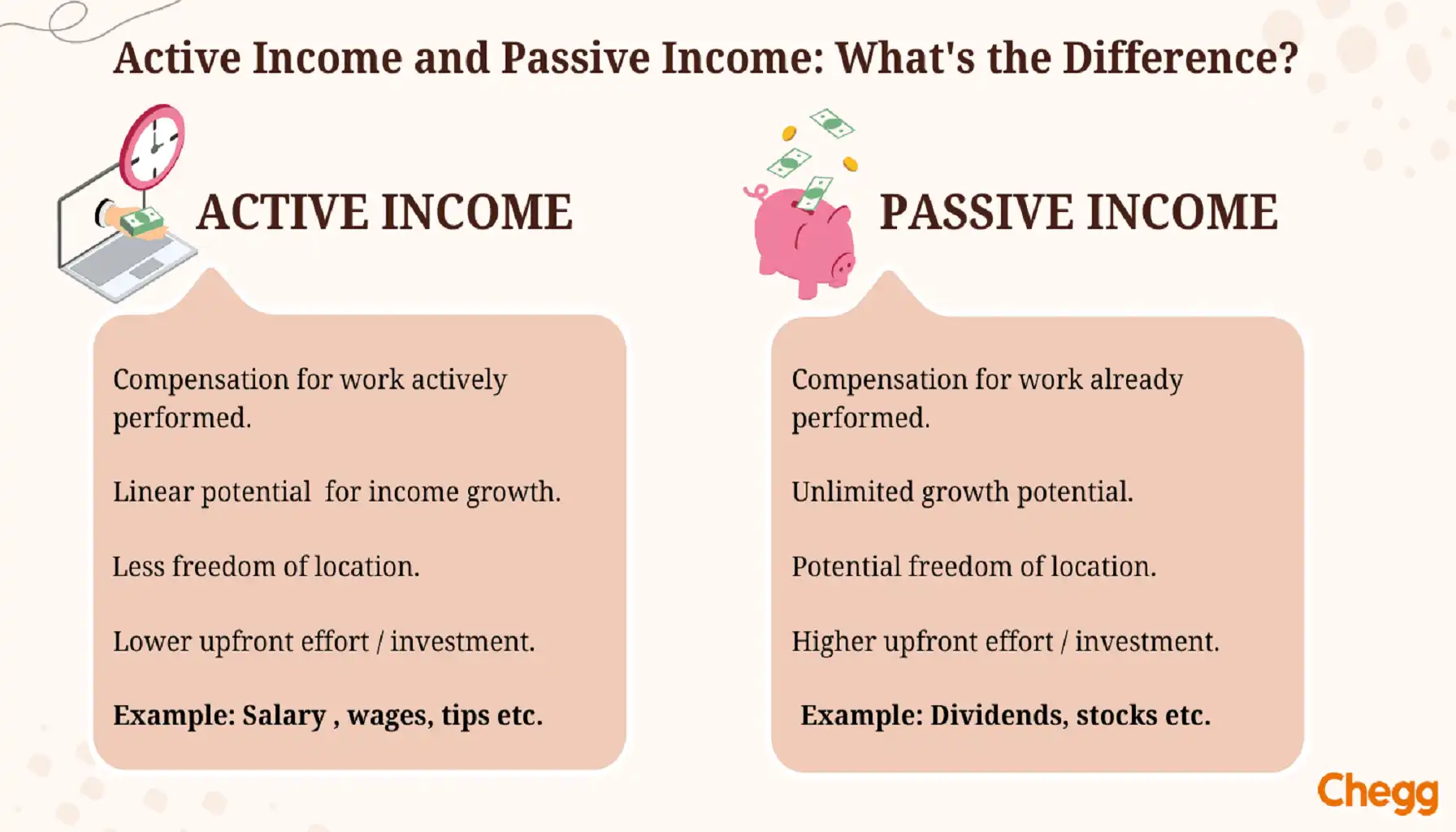

Earned vs. Passive vs. Investment

So, what is the difference between earned income, passive income, and investment income?

Earned Income | This is your typical 9-to-5 (or whatever hours you clock). It's the money you get for your direct effort – salary, hourly wages, freelance gigs, etc. You work, you get paid. Pretty straightforward. |

Passive Income | As we discussed, this requires upfront work, but generates income with minimal ongoing effort. Think of royalties from a book you wrote, income from an online course you created, or rental income from a property. There are so many passive income ideas 2025 and, of course, you can even learn how to make it if you put in the effort. |

Investment Income | This is income derived from investments – stocks, bonds, mutual funds, dividends, interest, capital gains, etc. It's your money making money. While you still have to manage your investments (and do your research!), the income generated isn't directly tied to your hourly effort. |

Best Ways to Make Passive Income

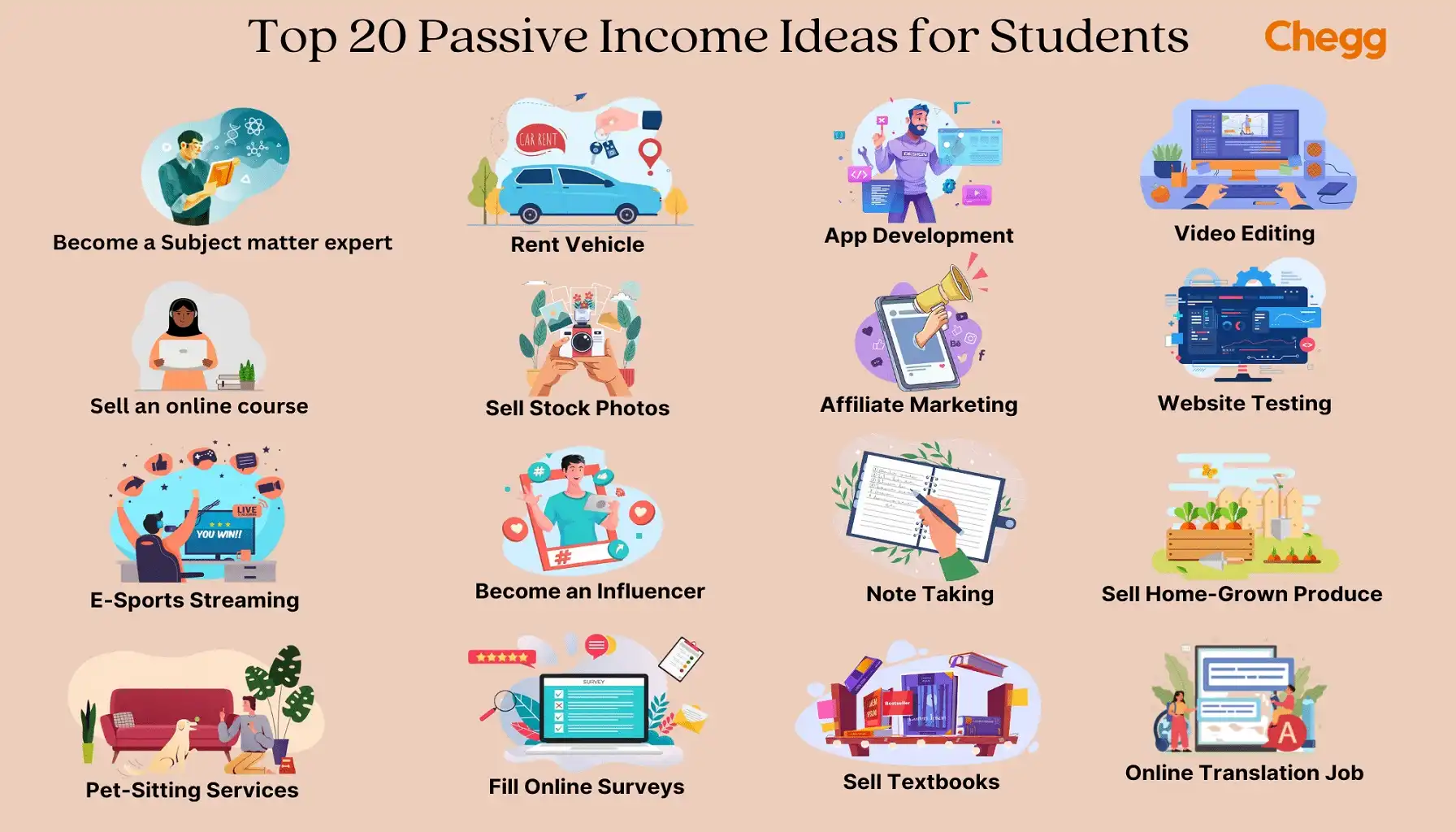

Alright, so what are the absolute hottest passive income strategies for 2025? We are talking about those opportunities that really make the most of technology, capitalize on what's new and trending, and actually provide value to people. You know, things you can systemize, automate, or monetize online.

We're gonna dive into some specifics, but just generally, keep an eye out for anything that can be scaled up.

Passive Income Examples that Actually Work

Think of the blogger who built up a loyal following and now earns ad revenue and affiliate commissions while they sleep. Or the photographer who sells stock photos online and earns royalties every time someone licenses their images. These are everyday people who figured out how to earn passive income, and you can too.

Passive Income Streams

Real Estate | Real estate passive income is a classic for a reason. It might require a larger initial investment, but rental income can provide a steady stream of cash flow. Plus, there's the potential for appreciation over time. Think about renting out apartments, condos, or even vacation homes. |

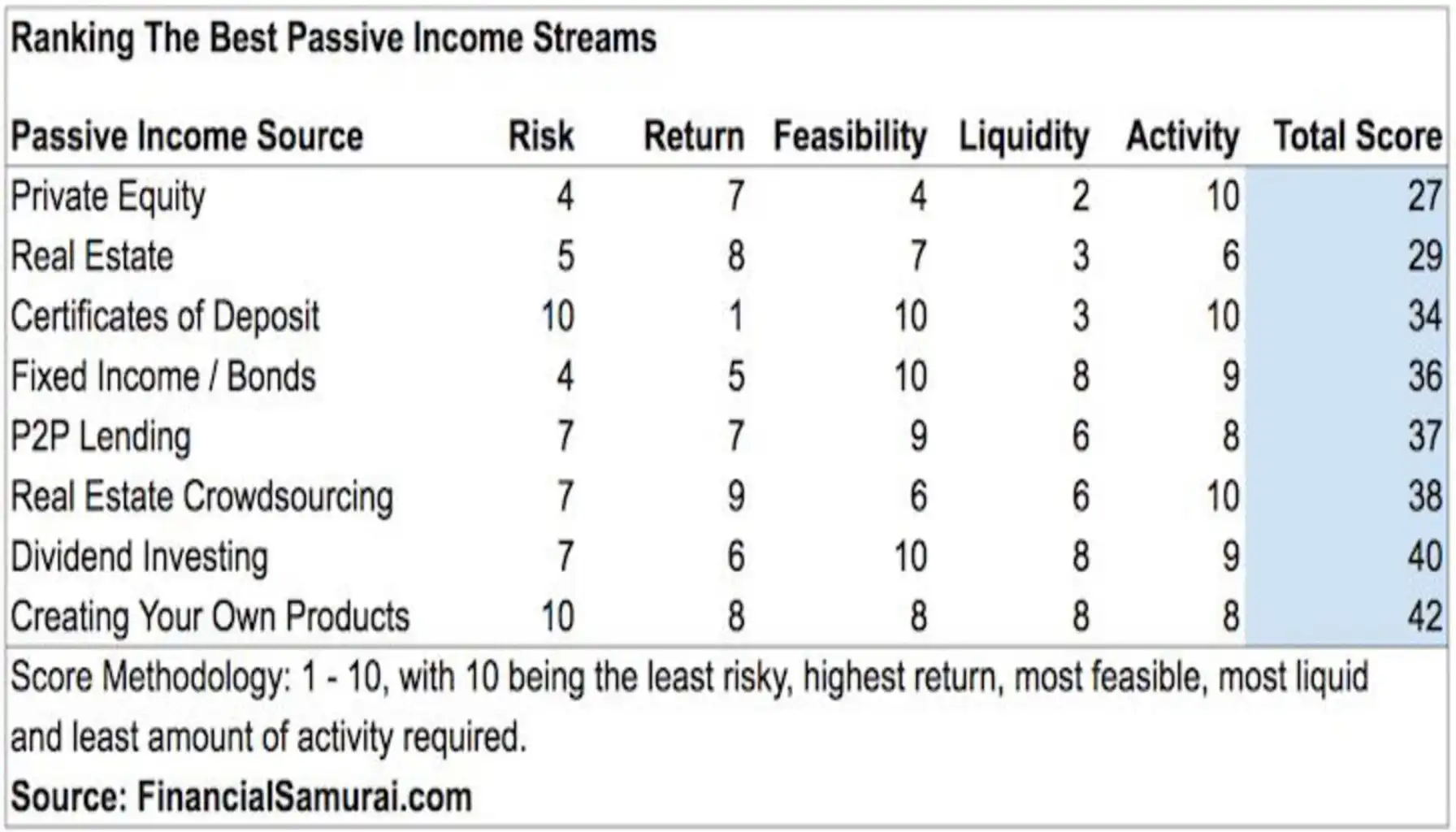

Investments | The stock market, bonds, and dividend-paying stocks are all great options. Mutual funds and ETFs can provide instant diversification and professional management. Of course, investments come with risk, so do your research. |

Automated Businesses and Online Courses | Think of creating a digital product – an ebook, an online course, a piece of software – and then automating the sales process. Once you've built the product, you can sell it repeatedly with minimal ongoing effort. |

Other Avenues | We're talking about everything from creating and selling printables on Etsy to earning royalties from music or photography. The options are practically limitless. It really just comes down to what you're good at and what you enjoy doing. |

How to Generate Passive Income With no Initial Funds

Identify Your Skills & Interests

What are you good at? What do you enjoy doing? The best passive income ventures leverage your existing knowledge and passions. Think of the 50 passive income ideas and which one you would actually enjoy doing.

Research

Don't jump into anything blindly. Research the potential profitability and time investment of different options.

Choose Your Platform & Niche

Where will you be selling your product or service? What specific audience are you targeting?

To properly understand your niche, you can take tests to determine your character and characteristics. Suddenly you're the rarest type of personality.

Create Something Valuable

Whether it's an ebook, a course, a website, or a physical product, make sure it offers real value to your target audience. This is KEY.

Automate and Scale

Once you've created your product, automate the sales process as much as possible. Use tools like email marketing, social media automation, and payment processors to streamline your workflow.

Promote

Don't expect people to magically find your product. Promote it through social media, email marketing, paid advertising, and word of mouth.

Track, Analyze, and Optimize

Monitor your results and make adjustments as needed. Don't be afraid to experiment and try new things.

Time management

With the right time management and a proper morning routine, it will be easier for you to achieve success and financial stability.

Pro Tips for Building Effective Passive Income

Focus on Quality over Quantity: A high-quality product that solves a real problem will always outperform a mediocre product with flashy marketing.

Not to Give up: If you have problems, despondency, or signs of depression, don't be patient, but contact a specialist right away.

Build an Audience: Creating a loyal following is essential for long-term success. Engage with your audience, provide value, and build relationships.

Diversify Your Income Streams: Don't put all your eggs in one basket. Explore multiple passive income options to reduce risk.

The Critical Factors for Success

It takes time to build. Don't expect to get rich overnight.

You'll likely face challenges along the way. Don't give up easily.

If you're not passionate about what you're doing, it will be difficult to stay motivated.

Also, keep in mind that some passive income jobs may require some investment of time and resources to get started. With dedication and a strategic approach, you can achieve your financial goals!

Zero Investment Options

Affiliate Marketing (Using Free Platforms): Build a following on a free platform like YouTube, TikTok, or Instagram, and promote affiliate products related to your niche.

Create and Sell Digital Products (Using Free Tools): Design free templates or resources using Canva or Google Docs and sell them on platforms with free listings (some will take a percentage).

Content Creation (Monetizing Free Content): Build a blog or YouTube channel and monetize it with ads or sponsorships.

Recommendations:

Don't rely on just one source of revenue. Spread your efforts across multiple streams for stability.

Leverage technology to handle repetitive tasks so you can focus on growth.

Invest time upfront to develop assets that generate ongoing revenue.

The more value you provide, the more people will be willing to pay for your products or services.

A loyal following is your most valuable asset. Engage with your audience and build relationships.

Building long-term revenue streams takes time and effort. Don't give up easily.

Use your profits to further grow your business or explore new opportunities.

Stay up-to-date on the latest trends and strategies so you can adapt and thrive.

You don't need a huge investment to get started. Begin with what you have and scale as you grow.

Building revenue streams should be fun and rewarding. Choose ventures that align with your passions and interests.